Mysterious $36.29 e-Transfer from MNP? Why Facebook Sent You: Ever received a random e-transfer for a seemingly insignificant amount? This often happens, and it’s crucial to understand the potential dangers lurking behind seemingly harmless transactions. We’ll unravel the mystery surrounding this specific case, exploring the possible connections to Facebook scams and the mobile number portability (MNP) system. Get ready to learn how to spot these scams and protect yourself.

This article will guide you through understanding e-transfers, investigating the potential link between MNP and fraudulent activities, and examining Facebook’s role in these scams. We’ll analyze the unusual $36.29 amount, discuss safety measures, and present illustrative scenarios to help you better understand and avoid such situations. By the end, you’ll be equipped with the knowledge to handle suspicious e-transfers confidently.

So you got a weird $36.29 e-transfer from MNP? It’s probably related to that Facebook ad you clicked, but honestly, who knows these days? Completely unrelated, but I just saw this news story about a North Korean soldier captured in Ukraine dies: reports , which is way more interesting than figuring out that random money. Anyway, back to your mystery money – maybe check your Facebook account activity for clues!

Understanding E-Transfers and Potential Scams

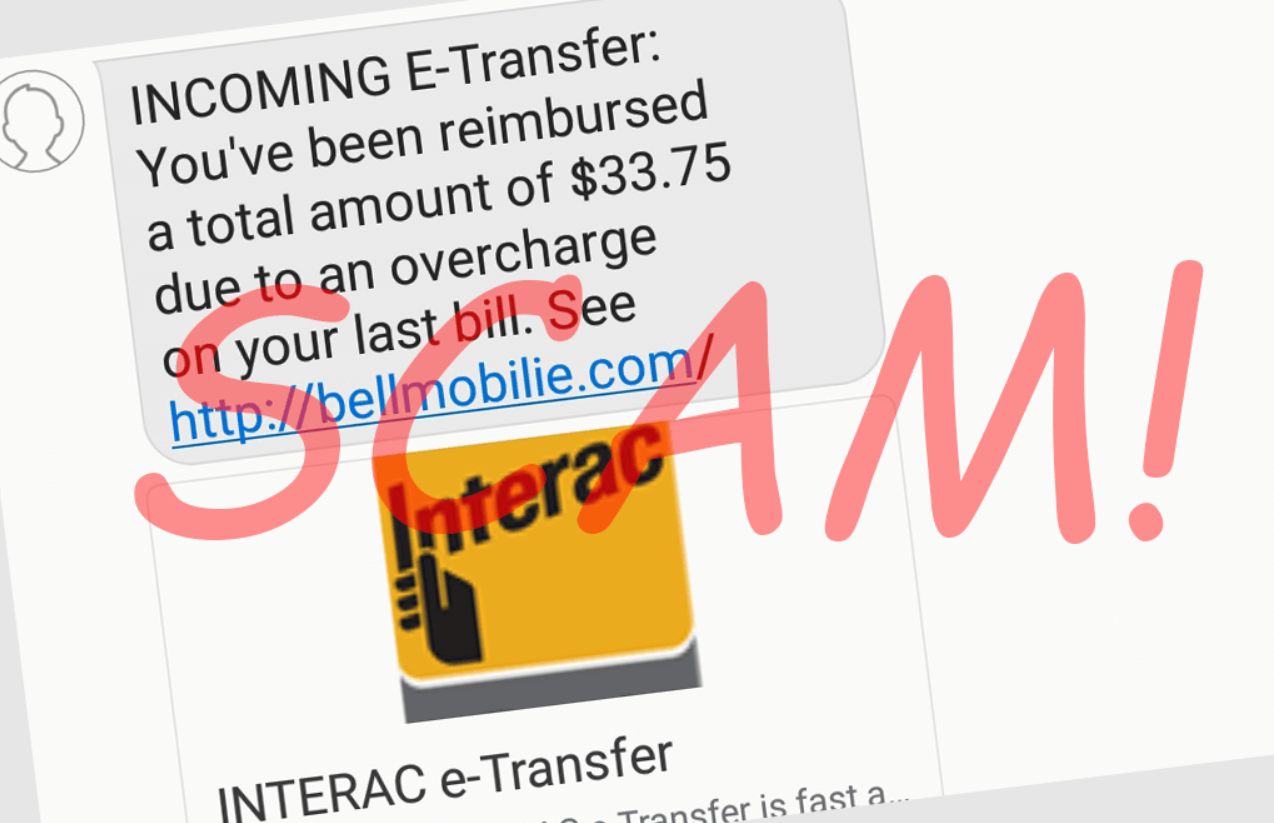

Receiving an unexpected e-transfer, especially a small amount like $36.29, can be unsettling. This article will guide you through understanding the process of e-transfers in Canada, common security measures, potential scams, and how to identify and avoid them, particularly when MNP and Facebook seem involved.

E-Transfer Processes and Security

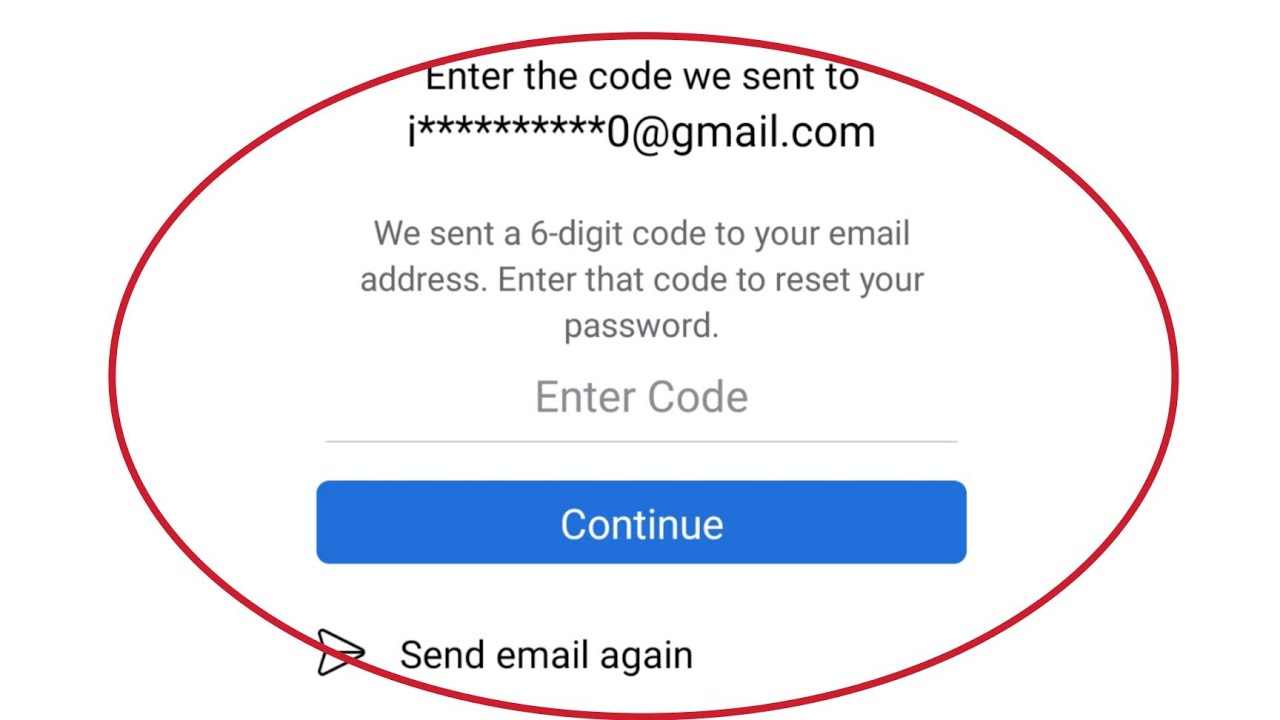

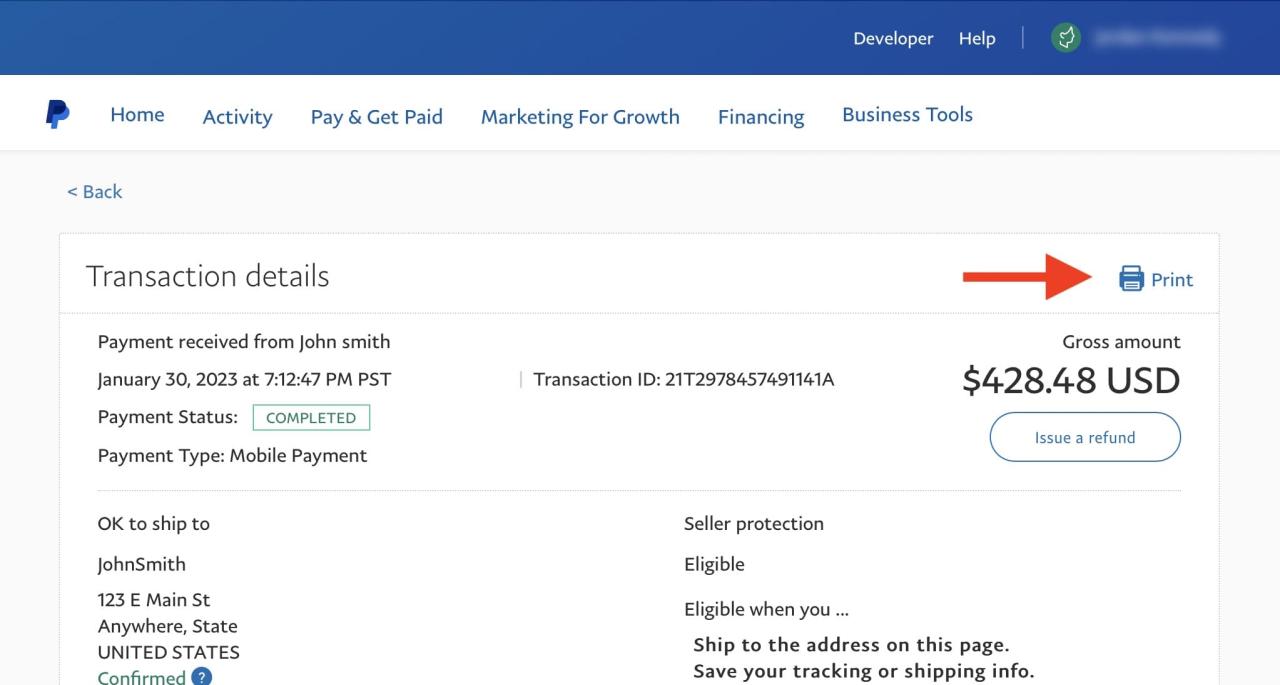

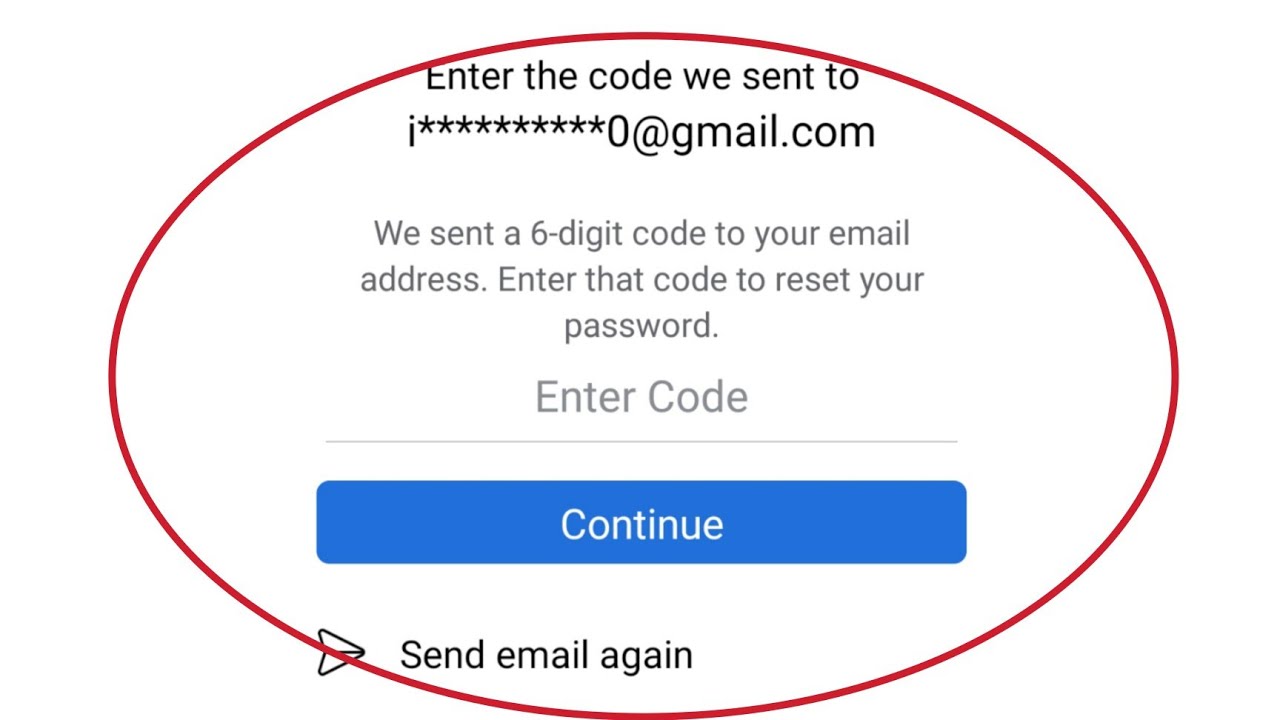

E-transfers in Canada, facilitated by major banks, typically involve the sender providing the recipient’s email address or mobile phone number. The recipient then receives a notification with an access code. Once this code is entered, the funds are deposited into the recipient’s account. Security features include password protection, security questions, and one-time codes. Legitimate reasons for unexpected e-transfers might include a refund, a payment from a friend or family member who made a mistake, or a partial payment for a service.

However, scammers often exploit this system. Common scams involve using stolen or compromised accounts to send small amounts to test if the recipient will claim the money. If successful, larger amounts might follow or the scammer might attempt to gather personal information through subsequent communication.

So you got a weird $36.29 e-transfer from MNP? Think it’s related to that Facebook thing? Maybe it’s totally unrelated, like that crazy story about Dobes getting a special admirer in Florida – check out the details here: Dobes aura une admiratrice particulière en Floride – TVA Sports. Anyway, back to your mystery money – best to contact MNP directly to figure out what’s up!

MNP and Fraudulent E-Transfers

Mobile Number Portability (MNP) allows users to switch cellular providers while retaining their phone number. Scammers can exploit this by porting a victim’s number to a new provider, intercepting verification codes, and gaining access to their financial accounts. This allows them to send seemingly legitimate e-transfers from a compromised account associated with the victim’s phone number.

A phone number is a crucial element in many financial scams. It serves as a verification method for online banking and e-transfer services. Scammers exploit vulnerabilities by gaining access to a victim’s number to reset passwords, receive verification codes, and initiate fraudulent transactions. For example, a scammer might port a victim’s number, then use it to access their banking app and initiate an e-transfer to their own account.

Another example would be using the ported number to receive a one-time password to access the victim’s email.

Facebook’s Role in Phishing Scams

Facebook can be a vector for phishing scams. Scammers create fake Facebook accounts or use compromised accounts to send messages impersonating legitimate entities, often banks or financial institutions. These messages often contain links to fake websites that look like legitimate login pages, tricking users into entering their credentials.

Scammers employ various methods, including creating profiles that mimic real people or businesses, sending messages with convincing narratives, and using sophisticated techniques to bypass Facebook’s security measures. Phishing attempts often mimic Facebook notifications about account activity, security updates, or even unexpected payments, urging users to click on malicious links.

Identifying fake Facebook communications requires careful scrutiny. Look for inconsistencies in spelling and grammar, suspicious links, requests for personal information, and messages that seem too good to be true. Always verify communications directly through the official website or app, rather than clicking on links within a message.

Analyzing the $36.29 Amount

The seemingly insignificant amount of $36.29 might be a deliberate tactic. Scammers might use small amounts to test whether an e-transfer will be claimed before sending larger sums. This helps them identify active and vulnerable accounts. A small amount also makes it less likely the victim will immediately report the transaction.

Small amounts can be part of larger, more elaborate scams. The initial small transfer is often a test or a way to establish trust before attempting larger financial crimes.

| Amount | Frequency in Scams | Possible Explanation | Risk Level |

|---|---|---|---|

| $36.29 | Low (but increasing) | Test transaction, part of a larger scam | Medium |

| $100 – $500 | High | Common amount for various scams | High |

| $1000+ | High | Large-scale fraud, identity theft | Very High |

| Variable | High | Scammers may vary amounts to avoid detection | High |

Safety and Prevention Measures, Mysterious .29 e-Transfer from MNP? Why Facebook Sent You

Responding to suspicious e-transfers requires caution. Never click on links in unsolicited emails or messages. Always verify the sender’s identity through an independent channel. Report any suspicious activity to your bank immediately.

- Never share personal information, including passwords and banking details, via email or text message.

- Regularly review your bank statements and look for unauthorized transactions.

- Enable two-factor authentication on all your online accounts.

- Use strong and unique passwords for each of your accounts.

- Keep your antivirus software up to date.

- Report suspicious e-transfers and phishing attempts to the Canadian Anti-Fraud Centre.

Illustrative Scenarios

Here are examples of how users might encounter and react to suspicious e-transfers.

Scenario 1 (Red Flags): A user receives an e-transfer of $36.29 from an unknown sender with the name “MNP Support” and a message mentioning a Facebook account issue. The red flags are the unknown sender, the vague message, and the unusual amount. The user should immediately contact their bank and report the suspicious transaction.

Scenario 2 (Avoiding a Scam): A user receives a similar e-transfer. However, they notice the sender’s name is misspelled, the email address is suspicious, and the message contains grammatical errors. Recognizing these red flags, the user ignores the e-transfer and contacts their bank to confirm the legitimacy of the transaction.

So you got a mysterious $36.29 e-transfer from MNP? Weird, right? Maybe it’s related to that Facebook thing, or maybe it’s completely unrelated, like celebrating Liverpool’s awesome 3-1 win against Leicester, check out the highlights here: Liverpool 3-1 Leicester: Cody Gakpo, Curtis Jones and Mohamed. Anyway, back to that money – definitely investigate that MNP transfer; it could be anything!

Scenario 3 (Consequences of Ignoring Red Flags): A user receives an e-transfer and, due to inattention, claims the money without verifying the sender. Subsequently, they receive numerous phishing emails and are targeted for a larger-scale financial scam, resulting in significant financial loss.

Final Summary

So, that seemingly innocent $36.29 e-transfer from MNP, potentially linked to a Facebook scam, can be a serious warning sign. Remember, vigilance is key. By understanding the mechanics of e-transfers, recognizing the red flags associated with scams involving MNP and Facebook, and following the safety measures Artikeld, you can significantly reduce your risk of becoming a victim. Stay informed, stay safe, and don’t hesitate to report suspicious activity.

Key Questions Answered: Mysterious .29 E-Transfer From MNP? Why Facebook Sent You

What is Mobile Number Portability (MNP)?

MNP lets you keep your phone number when switching providers.

Why would scammers use a small amount like $36.29?

Small amounts are less likely to trigger immediate suspicion, making them effective for testing or initial phases of larger scams.

What should I do if I receive a suspicious e-transfer?

Don’t accept or deposit it. Contact your bank and report it to the authorities.

How can I report suspicious financial activity?

Contact your bank and report it to the Canadian Anti-Fraud Centre.